Captain D’s Launches Global Expansion Plan, Naming Hair Parra to New Position of Senior Vice President of International Operations and Development

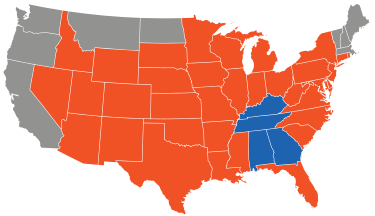

Fast Casual Seafood Leader Recently Signed Franchise Development Agreement in Canada; Widens International Focus to include Central and Latin America, Singapore, Indonesia and More Captain